The decision to hire experienced accountants can profoundly impact a company's financial performance. Their expertise not only streamlines complex processes like tax preparation and compliance but also equips businesses with the strategic insights necessary for effective budgeting and forecasting.

By identifying cost reduction opportunities and optimizing resource allocation, seasoned accountants play a crucial role in enhancing operational efficiency and profitability.

However, the question remains: how can these financial experts specifically tailor their skills to address the unique challenges faced by your organization?

The financial expertise of seasoned accountants is invaluable to any organization seeking to navigate the complexities of modern fiscal landscapes. These professionals bring a wealth of knowledge, enabling businesses to make informed decisions grounded in comprehensive financial analysis.

Their ability to interpret financial data accurately allows organizations to identify trends, manage risks, and allocate resources more effectively. Experienced accountants also provide strategic insights that help in budgeting and forecasting, ensuring that organizations remain agile in response to market changes.

Furthermore, their proficiency in regulatory compliance mitigates potential legal issues, safeguarding the organization's reputation. By leveraging their expertise, businesses can enhance operational efficiency and ultimately drive profitability, affirming the critical role that experienced accountants play in fostering sustainable growth.

When organizations prioritize streamlined tax preparation, they often find that experienced accountants play a pivotal role in simplifying the process. Their in-depth knowledge of tax regulations ensures compliance and minimizes the risk of errors that could lead to costly penalties.

Seasoned accountants utilize advanced software and methodologies to organize financial data systematically, allowing for quicker and more accurate tax filings. They also stay updated on the latest tax laws and incentives, enabling organizations to take advantage of potential deductions and credits.

By implementing efficient tax strategies, these professionals maximize available resources, ultimately enhancing financial performance. Consequently, businesses can focus on their core operations, confident that their tax obligations are managed effectively and efficiently.

Effective cost reduction strategies are essential for organizations seeking to enhance their profitability and operational efficiency. Experienced accountants play a pivotal role in identifying inefficiencies within financial processes, allowing businesses to streamline operations.

By conducting thorough cost analyses, these professionals can pinpoint areas of overspending and recommend actionable solutions. Implementing budget controls and forecasting techniques helps organizations allocate resources more effectively, reducing unnecessary expenditures. Moreover, experienced accountants can leverage technology to automate routine tasks, minimizing labor costs.

They also provide insights into vendor negotiations and supply chain management, further driving down costs. Ultimately, the expertise of seasoned accountants enables organizations to adopt a proactive approach to cost management, ensuring sustainable financial health and improved bottom lines.

Navigating the complexities of financial regulations requires a robust framework for compliance and risk management, where experienced accountants serve as critical navigators. Their expertise ensures that organizations adhere to ever-evolving laws and standards, significantly reducing the risk of costly penalties and reputational damage.

By implementing comprehensive internal controls and conducting regular audits, experienced accountants identify potential compliance gaps and mitigate risks before they escalate. Moreover, their familiarity with industry-specific regulations enables businesses to stay ahead of regulatory changes for a culture of accountability and ethical financial practices.

This proactive approach not only safeguards the organization's assets but also enhances stakeholder trust, ultimately contributing to a sustainable bottom line. Investing in seasoned accountants is a strategic decision that fortifies financial integrity and stability.

Strategic financial forecasting serves as a roadmap for organizations seeking to align their financial goals with market realities. By analyzing historical data and current economic trends, experienced accountants can develop accurate projections that inform decision-making.

These forecasts enable businesses to anticipate revenue fluctuations, manage expenses effectively, and allocate resources wisely. Additionally, they help identify potential risks and opportunities in the market. Utilizing advanced analytical tools, accountants can refine their forecasts, enhancing precision and reliability.

This strategic approach to financial planning not only improves operational efficiency but also fosters stakeholder confidence. Ultimately, leveraging the expertise of seasoned accountants in financial forecasting can significantly enhance an organization's financial performance and long-term sustainability.

Fostering long-term business growth requires a comprehensive understanding of market dynamics and a commitment to sustainable practices. Experienced accountants play a crucial role in this process by providing strategic insights that drive sound decision-making.

They analyze financial data to identify trends, enabling businesses to adapt proactively to market changes. By streamlining financial operations and optimizing resource allocation, seasoned accountants help businesses invest wisely in innovation and expansion.

This proactive financial stewardship not only enhances profitability but also builds a solid foundation for enduring success. Ultimately, hiring experienced accountants is an investment in the future viability and growth potential of any organization.

Accountants can indeed assist with non-financial business challenges by leveraging their analytical skills and industry knowledge. They provide valuable insights into operational efficiency, assist in strategic planning, and help with compliance and risk management. Additionally, accountants can support businesses in areas such as budgeting, forecasting, and resource allocation, ensuring that organizations make informed decisions that align with their overall goals. Their expertise fosters a holistic approach to problem-solving beyond traditional financial matters.

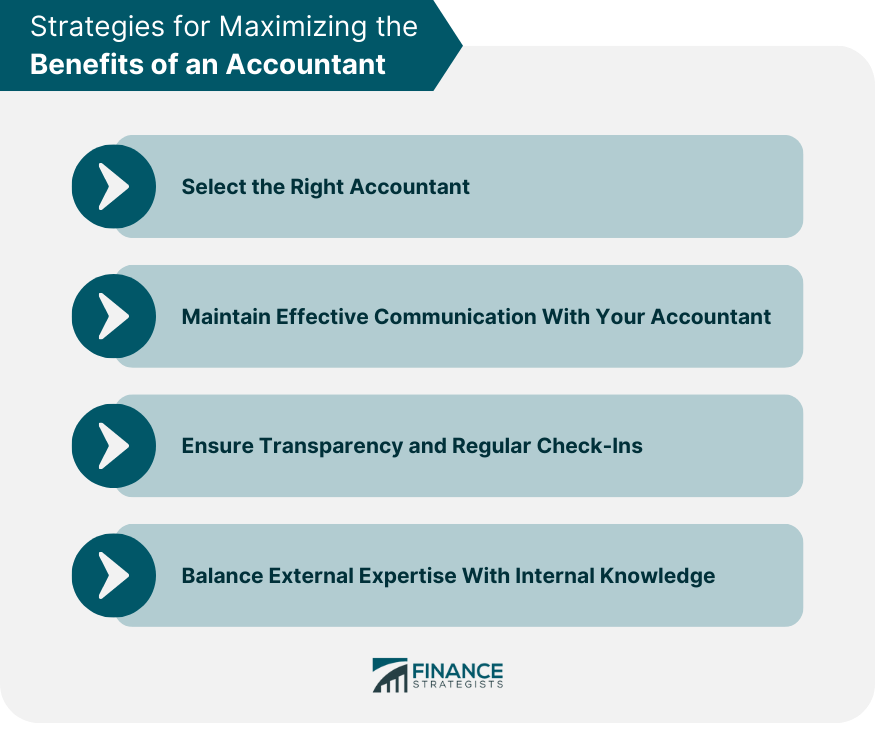

When seeking an accountant, it is essential to consider several qualifications. Look for candidates with a relevant degree in accounting or finance, and preferably, professional certifications such as CPA (Certified Public Accountant) or CMA (Certified Management Accountant). Experience in your industry can be advantageous, as well as proficiency in accounting software. Strong analytical skills, attention to detail, and effective communication abilities are also critical attributes for a qualified accountant to possess.

When hiring an accountant, several common mistakes should be avoided. First, neglecting to assess their qualifications and experience relevant to your industry can lead to misalignment. Additionally, failing to check references or reviews may result in hiring an underperformer. It is also crucial not to overlook the importance of communication skills; an accountant must convey complex information clearly. Lastly, avoid making decisions based solely on cost, as quality service often requires a reasonable investment.